top of page

Search

Event‑Driven Investing Using Global Macro Alternative Data and AI

But as markets evolve and geopolitical realignments accelerate in 2026, global macro risks increasingly impact all investment strategies across asset classes and sectors. This post provides guidance on how to extend event-driven strategies with global macro data and inputs in order to maximize alpha generation and smart beta portfolio management strategies.

BCMstrategy, Inc.

Jan 216 min read

AI in Finance: Top 3 Trends in 2026

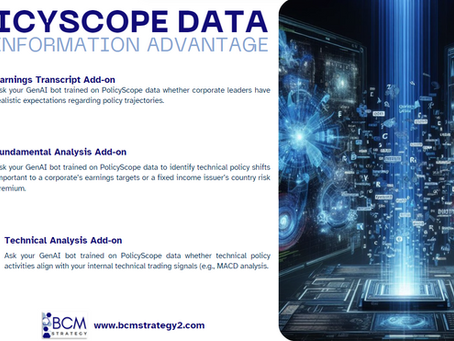

Portfolio managers, advocates, wealth managers, and chief economists need AI-powered tools that deliver more than automated summaries from social media, blogposts and newspapers. Automated research assistants powered by AI are emerging as game-changers in finance. To celebrate the new year, here are the top three AI in finance trends for 2026:

BCMstrategy, Inc.

Dec 30, 20253 min read

How to "Win" Earnings Season with Generative AI

Earnings season arrives in July. Are you ready? Equity analysts will face unprecedented pressures to provide solid guidance regarding...

BCMstrategy, Inc.

Jun 5, 20255 min read

How to Manage Global Macro Policy Volatility

And so it begins. Japan today continues the global trend of electing to leadership another outsider whose views on a range of issues run...

macroVS

Sep 27, 20243 min read

Scroll to the bottom to find and download our mobile app.

Members

Bobby Fitness Studio

Join us on mobile!

Blogposts, White Papers, & more

delivered directly to you

via the Spaces by Wix app.

bottom of page