Anticipating Stablecoin and Reserve Currency Dramas

- BCMstrategy, Inc.

- Jul 11, 2025

- 3 min read

This morning's NYT op-ed is right on the money...and we have the data to prove it (see the charts below). While the rest of the world watches the trade and tariff war of words, savvy global macro strategists are keeping a close eye on the House of Representatives in the United States. We will end this month with legal certainty regarding crypto regulation in the United States; many expect this move will unleash a dramatic increase in demand for dollar-backed stablecoins.

Next week, the House will vote on three bills that will create a legal framework for stablecoin and crypto regulation while outlawing Federal Reserve digital dollar issuance. See the latest op-ed from the Atlantic Council HERE for details.

Global central banks already see themselves in competition with dollar-backed stablecoins. The policy reaction function measured by PolicyScope DCVS data the week after Senate passage of parallel bills in late June was striking:

The distribution of policy activity during June also showed which central banks are feeling the heat from the fast track US legislation:

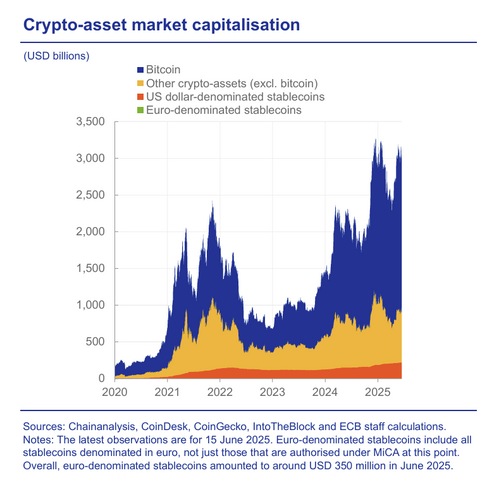

The ECB backed up its concerns with data

Volumes and warning bells then skyrocketed on June 29 when the normally staid Bank for International Settlements published an extraordinary broadside against stablecoins while making the case for a unified central bank ledger to support CBDCs.

And all of this is BEFORE we consider the significant challenges that China and Russia seek to pose to the dollar's global role.

We've been writing about this issue for the Atlantic Council since late 2023:

Anticipating stablecoin and reserve currency dramas and reaction functions from here is not difficult for those using PolicyScope DCVS data to train their predictive analytics and generative AI applications.

Next week's Senate vote will trigger more reaction functions globally. Those reaction functions will play out during autumn 2025 and throughout 2026 against a backdrop of intensifying global macro tensions and geopolitical rebalancing punctuated by trade and tariff wars.

PolicyScope data measures ALL of these moves daily, twice a day, making it easy for portfolio managers and strategists to spot the trends early.

Whether you take the tickerized data feed to power trading signals or you take the structured language data feed to train your generative AI, the time to act is now so that you are ready for the next flurry of predictable activity in the autumn.

BCMstrategy, Inc. helps portfolio managers and strategists anticipate public policy shifts by delivering quantitative and structured language training data to support a broad range of automated analytical and trading processes. The data is generated using the patented, award-winning PolicyScope process across a range of policy issues from digital currency and trade policy to monetary policy and energy/climate policy.